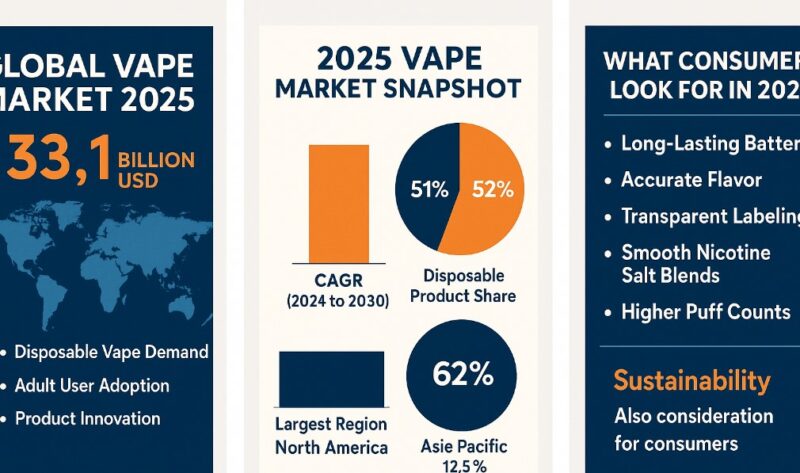

The global vape market in 2025 is valued at 33.1 billion USD, according to the most recent consolidated industry data. This figure represents a clear rise from 2024 and signals that vaping has become a mature consumer category rather than a trend. Growth is driven by disposable vape demand, expanding adult user adoption, and stronger product innovation across North America, Europe, and the Asia Pacific.

Global Market Overview 2025

Industry analysts report the market’s compound annual growth rate (CAGR) at 9.4 percent from 2024 to 2030. Disposables remain the fastest-moving category with over 51 percent of total product share. Nicotine salt formulations now represent 62 percent of all e-liquid consumption worldwide due to their smoother delivery and higher satisfaction levels.

2025 Vape Market Snapshot

| Metric | Exact 2025 Value |

| Global market size | 33.1 billion USD |

| Projected CAGR (2024 to 2030) | 9.4 percent |

| Disposable product share | 51 percent |

| Nicotine salt share of liquids | 62 percent |

| Largest region by revenue | North America |

| Fastest growth rate | Asia Pacific (12.5 percent) |

These numbers show a stable, predictable industry where product improvements and regulated nicotine formats drive nearly all revenue growth.

North America Holds the Largest Share

North America accounts for 38 percent of the global vape market in 2025. The United States is the dominant force, supported by widespread retail access, a high population of former smokers, and an aggressive disposable segment.

Several factors keep the region at the top:

- High adoption among adults switching from cigarettes

- Strong brand competition leading to better coil and battery design

- Rapid turnover in flavors and disposable models

- A large returning customer base

Disposables now make up over 58 percent of all vape sales in the US. Pod systems remain the choice for long-term users who prioritize flavor consistency and device longevity.

Europe Remains the Second Largest Market

Europe represents 29 percent of global vape revenue in 2025. The region grows steadily, not rapidly, due to strict nicotine caps and marketing regulations. Still, adult smokers continue to transition to vape products as a reduction or cessation tool.

Key markets include:

- United Kingdom – the largest European vape economy

- Germany – strong growth in refillable pod systems

- France and Italy – rising adoption of nicotine salt formats

Europe differs from North America in one clear way. Refillable systems are more popular because they provide long-term savings under higher tax conditions. Disposables grow, but they do not dominate.

Major European Market Stats 2025

| Country | Market Size 2025 | Key Trend |

| UK | 3.4 billion USD | Nicotine salts + pod systems |

| Germany | 1.8 billion USD | Refillable pods outperform disposables |

| France | 1.3 billion USD | High 20 mg nicotine cap keeps demand steady |

Asia Pacific Leads in Growth Speed

Asia Pacific records the highest regional growth rate at 12.5 percent in 2025. China continues to dominate the production of hardware, contributing over 85 percent of global vape device manufacturing. Japan, South Korea, and the Philippines show rapid user expansion.

Drivers in this region include:

- Large young adult population

- Explosive e-commerce growth

- Competitive mid-range disposables

- Lower production costs enable better device performance

China’s domestic vape market alone is valued at 2.7 billion USD in 2025, despite regulation changes.

Middle East and Latin America: Smaller but Rapidly Moving Segments

The Middle East has one of the highest per-user spending levels. The UAE and Saudi Arabia lead regional demand, valuing premium flavors and long-lasting devices. This region grows at 9 to 10 percent annually.

Latin America is smaller but expanding. Brazil, Mexico, and Argentina lead with 6 to 8 percent annual growth. Fragmented regulations slow down uniform expansion, but adult users steadily shift away from cigarettes due to taxation increases on traditional tobacco.

Concrete Insight in the Middle of the Article

By mid-2025, the biggest force behind vape revenue is the dominance of flavored disposables with improved coil and battery performance. Returning adult users increasingly choose premium flavor brands rather than the cheapest option. This aligns with the rise of boutique flavored hookah pen and vape brands such as BlakkSmoke that build demand not through volume alone but through flavor identity, consistent performance, and a device that’s nicotine and tobacco-free.

What Consumers Look For in 2025

Industry surveys show a clear set of priorities among adult vape users.

Top User Preferences

- Long-lasting batteries with stable voltage output

- Accurate flavor that does not fade before the device ends

- Transparent ingredient labeling

- Smooth nicotine salt blends

- Higher puff counts with consistent vapor density

Sustainability also influences buying decisions. Users prefer companies offering recycling programs or reduced waste designs. Some brands begin shifting to biodegradable plastics and improved recovery protocols.

Factors Driving Global Growth

Three specific drivers shape the 2025 landscape:

- Switching from Cigarettes

Over 46 million adults worldwide have transitioned from smoking to vaping as a harm reduction strategy.

- Technology Improvements

Mesh coils, high-capacity batteries, and refined nicotine salts significantly improve user satisfaction and reduce device failure rates.

- Online Retail Expansion

E-commerce now handles over 35 percent of global vape sales due to easier product comparison and faster delivery.

These drivers collectively support long-term market stability.

Key Challenges in 2025

Despite growth, the industry faces several challenges that influence strategy.

Regulation Pressure Table

| Challenge | Impact in 2025 |

| Nicotine caps | The 20 mg limit in the EU restricts flavors and strengths |

| Flavor bans | US state-level bans alter distribution channels |

| Sustainability requirements | Push toward recyclable components |

| Youth protection laws | More rigorous age-verification systems |

These issues do not stop industry expansion but force brands to evolve.

2025 Outlook and Final Numbers

The vape market is not slowing. Disposables lead global sales. Pod systems maintain a loyal base. Asia Pacific grows fastest. North America remains the largest revenue generator. Europe stays steady under tight regulation.

Exact market prediction for year-end 2025:

- 1 to 34.0 billion USD estimated final market value

- Over 50 percent disposable market share

- Over 62 percent of nicotine salt consumption

- 9 to 13 percent regional growth across most areas

The data shows a stable, maturing industry built on technology improvement, adult user preference, and continuous product refinement.