XRP has been making waves in the crypto world for years now. Some love it. Some dismiss it. But here’s the thing: it keeps proving skeptics wrong.

What started as a solution for slow, expensive international payments has grown into something much bigger. Today, XRP powers a whole ecosystem of tools, platforms, and real world applications.

Sending money internationally through traditional banks is painfully slow. We’re talking three to five business days, sometimes longer. Fees stack up at every step. And the process involves way too many intermediaries.

XRP transactions settle in under five seconds. Fees are fractions of a penny. While Bitcoin miners burn electricity equivalent to small countries, XRP validates transactions efficiently and sustainably.

If you’ve been curious about XRP but felt overwhelmed by conflicting information, you’re in the right place. This guide cuts through the noise and focuses on what actually matters.

Getting Your Hands on XRP

So you’ve decided to explore XRP. Great. But where do you actually get it?

The platform you choose matters more than you might think. Fees, security, ease of use, and available payment methods vary wildly between services.

What are the Simple Options

Not everyone wants to become a trading expert. Some people just want to own XRP without jumping through hoops.

MoonPay stands out for users who want to buy XRP without the complexity that plagues many crypto platforms. You can use your credit card or bank transfer and complete the whole process in minutes.

The interface is clean. The fees are transparent. Customer support actually responds when you need help. For newcomers especially, this kind of simplicity makes all the difference.

Security matters too. Reputable platforms invest heavily in protecting your information and funds. Before committing to any service, check their track record and read what actual users say about their experiences.

Trading Platforms for the More Adventurous

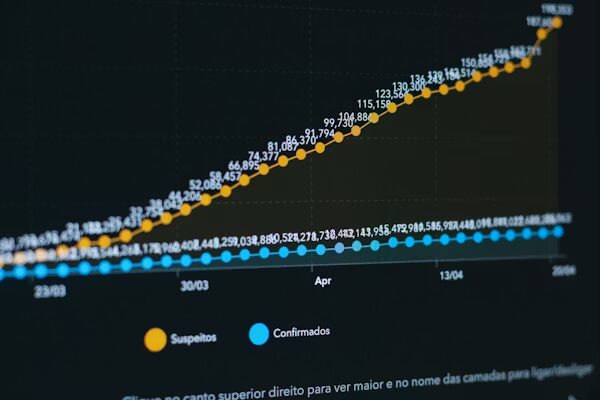

Maybe you want more than just buying and holding. Maybe charts excite you. Maybe you want to trade XRP against other cryptocurrencies.

Exchanges cater to this crowd. They offer advanced order types, detailed analytics, and multiple trading pairs. You can set limit orders, stop losses, and execute more sophisticated strategies.

Liquidity should factor into your decision. Higher liquidity means tighter spreads and better prices when you execute trades. Low liquidity platforms can cost you money through slippage.

Check the security history of any exchange you consider. Hacks happen. Platforms that have weathered attacks and reimbursed users demonstrate commitment to their customers. Those that haven’t… Well, learn from others’ mistakes.

Some exchanges offer staking or interest programs for XRP. These can generate passive returns, but always understand the terms. Your assets might be locked for certain periods, and risks exist that you should evaluate carefully.

Keeping Your XRP Safe

Here’s an uncomfortable truth: owning crypto means taking responsibility for your own security. No bank will reverse a fraudulent transaction. No customer service rep will recover stolen funds.

The good news? Solid wallet options exist that make security manageable.

Hardware Wallets: Your Personal Vault

Hardware wallets are physical devices that store your private keys offline. Hackers can’t steal what they can’t reach.

These devices look like USB drives. When you want to send XRP, you connect the device and physically authorize the transaction. Without that authorization, your funds stay locked.

Yes, they cost money upfront. But if you’re holding any significant amount of XRP, that investment pays for itself in peace of mind.

Major hardware wallet brands support XRP natively. Setup takes maybe fifteen minutes. After that, your holdings are as secure as they can possibly be.

Software Wallets: Everyday Convenience

Hardware wallets are great for long term storage. But what about daily use?

Software wallets run on your phone or computer. They’re convenient for smaller amounts you might want to access quickly.

The XRP Ledger has several dedicated wallet apps built specifically for its ecosystem. Many include extra features like built in exchanges and support for other tokens on the network.

Stick to wallets with strong reputations and active development. Download only from official sources. Scammers create convincing fakes designed to steal your funds.

The Custody Question

When you leave XRP on an exchange, the exchange controls your private keys. They’re holding your assets on your behalf.

This isn’t necessarily bad. Reputable exchanges have robust security. And for active traders, keeping funds on an exchange makes practical sense.

But there’s risk involved. Exchanges can get hacked. They can freeze accounts. They can go bankrupt.

Non custodial wallets put you in complete control. You hold the keys. Nobody can touch your funds without your authorization.

Most experienced crypto users split their holdings. Trading amounts stay on exchanges for convenience. Larger holdings move to secure personal wallets. This balanced approach works well for most situations.

How XRP Actually Gets Used

Speculation drives a lot of crypto activity. But XRP has something many projects lack: genuine utility. Real businesses use it to solve real problems.

- Moving money across borders – Cross-border payments are XRP’s core use case. Traditional remittance services are slow and expensive, often taking days and cutting into transfers with high fees. XRP settles transactions in seconds at a fraction of the cost, allowing recipients to receive more money, faster. Financial institutions using XRP for liquidity have reported meaningful cost savings that can translate into lower consumer fees.

- Tiny payments with real potential – Sending small amounts online is impractical with conventional payment processors due to fixed fees. XRP’s low transaction costs make micropayments viable. This enables tipping for content creators, pay-per-use services, and other models that don’t rely on subscriptions. The infrastructure is already in place, even if many use cases are still emerging.

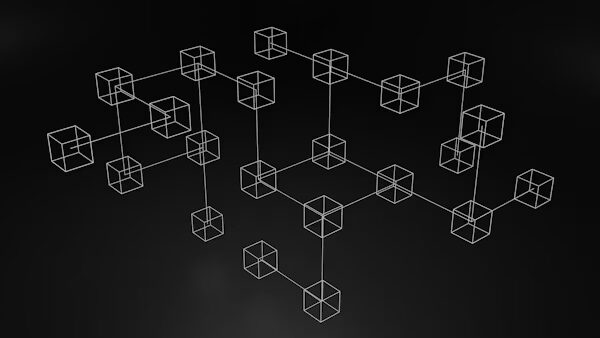

- More than simple transfers – The XRP Ledger supports custom tokens, allowing organizations to create digital assets tied to real-world value, such as loyalty points, tickets, or ownership records. This capability supports broader experimentation in digital finance, with developers continuing to expand what the ecosystem can support.

Tools and Resources Worth Knowing

The XRP community has built an impressive collection of tools. Whether you’re a developer or just someone trying to learn, resources abound.

For the Builders

Developers interested in building on XRP have solid documentation to work with. Tutorials walk through common implementations. API references cover the technical details.

Testnet environments let you experiment without risking real money. Libraries exist for popular programming languages. Community forums provide help when you get stuck.

This infrastructure encourages innovation. New applications emerge regularly, expanding what’s possible on the network.

For the Curious

You don’t need to be technical to learn about XRP. Educational content spans every level of expertise.

Podcasts discuss market developments and technology updates. Video creators explain concepts visually. Written analyses dive deep into specific topics.

Engaging with community discussions accelerates learning. People share insights, debate ideas, and help newcomers understand confusing concepts.

Before You Invest

Crypto can make money. Crypto can lose money. Anyone who tells you otherwise is selling something.

Before putting funds into XRP or any cryptocurrency, think carefully about what you’re doing.

Do Your Homework

Read about technology. Follow developments around Ripple and the XRP Ledger. Understand what you’re investing in beyond just price predictions.

Consider how XRP fits your overall financial situation. Don’t put in money you’ll need next month. Don’t bet the rent. Seriously.

Diversification matters. Spreading risk across different assets protects you from any single investment going wrong.

Have a Plan

Random buying and selling based on emotions usually ends poorly. Having a strategy helps you stay disciplined.

Some people buy fixed amounts at regular intervals, regardless of price. This approach, called dollar cost averaging, removes the stress of timing decisions.

Others prefer active management, adjusting positions based on market conditions. Either approach can work, but pick one and stick with it.

Beginning with a small amount helps you learn the process without significant financial exposure.

Putting It All Together

XRP offers something genuinely useful: fast, cheap value transfer that actually works. That utility has sustained it through market cycles that killed lesser projects.

The ecosystem continues maturing. Platforms make acquisition straightforward. Wallets provide secure storage options. Real applications demonstrate practical value.

Is XRP a sure thing? Nothing in crypto is. But it’s built on solid fundamentals with genuine use cases and institutional interest.

Whatever you decide, approach the space with curiosity and caution. Learn continuously. Secure your holdings properly. And never invest more than you can afford to lose.

The future of payments is evolving. XRP is part of that story. Whether it becomes a central character or a supporting player remains to be seen. But it’s certainly worth paying attention to.