PayPal announced that customers could purchase, hold, and sell Bitcoin, Ethereum, Litecoin, and Bitcoin Cash directly in their PayPal account in 2021.

This marked a significant milestone, as it was the first international expansion of PayPal’s popular crypto service since its launch in the United States the previous year.

Customers can now conveniently fund crypto purchases using their existing bank accounts or debit cards. Selling crypto is just as easy, with funds readily available within their PayPal account.

For PayPal’s vast customer base, this integration opens the door to the world of cryptocurrencies, which are often perceived as complex. Buying, selling, and holding crypto is now just a few clicks away within a familiar platform.

It is worth noting that PayPal’s centralized system and lack of private key access may not appeal to all crypto users who value complete control and decentralization.

However, the development is potentially a game-changer for numerous industries including iGaming, which already has strong links with PayPal.

Leading operators such as Betway facilitate PayPal payments, but the introduction of a stablecoin by the same company could spark a significant spike in customer numbers.

Read on as we look at PayPal’s involvement with cryptocurrencies before assessing how this latest development could impact the global iGaming sector.

PayPal’s Evolving Relationship With Cryptocurrencies

PayPal’s journey with cryptocurrencies has been anything but smooth sailing. When Bitcoin reached its all-time high in 2018, the payment giant sent shockwaves through the crypto community by drastically limiting cryptocurrency transactions.

While Bitcoin users celebrated the surge in value, PayPal adopted a much more cautious approach. The primary concern was the wildly fluctuating price of cryptocurrencies, leading PayPal to take a cautious approach to the technology.

While they acknowledged the potential benefits of crypto, they believed the volatility wasn’t worth the risk. However, the tide has turned. Recognizing that cryptocurrencies are no longer quite as volatile, PayPal’s stance on the subject has undergone a major U-turn.

They now offer various services that allow customers and businesses to utilize cryptocurrencies effectively. This move could trigger a domino effect, with other payment processors likely to feel compelled to follow suit and offer similar crypto services.

PayPal Makes History With Stablecoin Launch

PayPal made a groundbreaking move in August 2023, becoming the first major United States financial institution to launch a stablecoin.

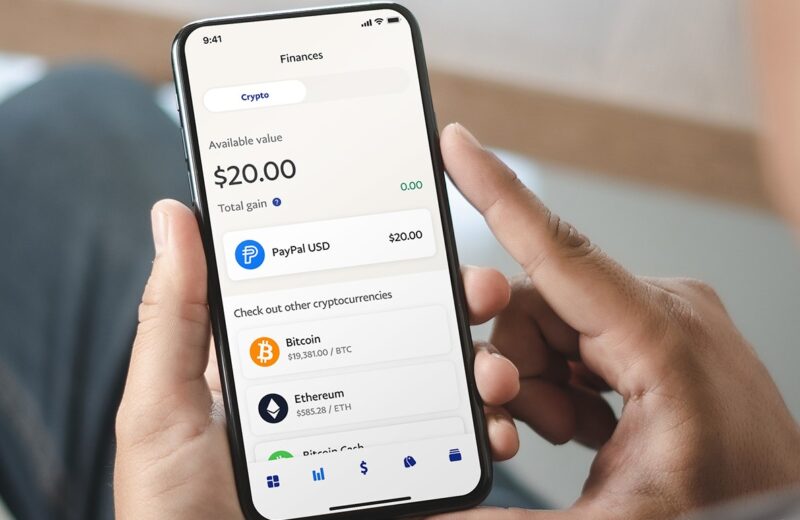

Dubbed PayPal USD (PYUSD), this digital asset is backed by the US dollar and aims to revolutionize online transactions within the burgeoning Web3 ecosystem.

PYUSD addresses the hurdles associated with payments in virtual worlds and decentralized environments. By offering fast, frictionless transactions, it aims to empower developers and create seamless financial experiences for customers.

Backed by a combination of dollar deposits, United States Treasuries, and cash equivalents, PYUSD offers crucial stability compared to traditional cryptocurrencies prone to price fluctuations.

This could incentivize customers, especially those new to the crypto space, to explore digital assets with greater confidence.

While PayPal’s motivations behind PYUSD may be multifaceted, its launch has the potential to significantly impact the future of crypto adoption.

The established trust associated with the company, coupled with the innovative features of the stablecoin, could pave the way for wider acceptance of digital assets among the general public.

PayPal’s move is a strategic play to solidify its position as a leader in the financial services sector, leveraging a digital asset for lower-cost and instant transactions without a central intermediary.

Crypto Making Waves in The Global Sector

Several countries across the globe have softened their stance on the idea of incorporating crypto payments, and Ireland is at the forefront of this trend.

The Central Bank of Ireland (CBI) has officially authorized fintech firms Ripple and Zodia Markets as Virtual Asset Service Providers (VASPs), paving the way for wider crypto adoption on the Emerald Isle.

This move follows Ireland’s recent embrace of crypto and blockchain technology, which has helped to position it as a crypto-friendly nation.

With the CBI’s approval, Ripple and Zodia joined established players such as Coinbase, Gemini, and Kraken in Ireland’s growing VASP landscape.

The authorization is particularly significant as it allows these companies to offer crucial services such as over-the-counter (OTC) trading and exchange to institutional clients within Ireland.

This opens doors for streamlined and secure transactions for businesses looking to engage with the digital asset ecosystem.

PayPal Stablecoin ─ A Game-Changer for The iGaming Industry

The involvement of a major global payment service such as PayPal is a pivotal moment for the crypto sector as it instills a newfound level of trust into the turbulent landscape.

The arrival of PYUSD has also shaken up the online gambling industry. With PayPal already a widely accepted payment option at many online casinos, the arrival of PYUSD could be a major game-changer, especially for players seeking the security and convenience of a PayPal casino.

Stablecoins such as PYUSD offer faster transaction processing times and potentially lower fees compared to traditional payment methods. This could lead to a smoother and more efficient experience for online casino players.

Unlike traditional cryptocurrencies known for their price fluctuations, PYUSD is pegged to the more stable US dollar, thus minimizing the volatility risks associated with deposits and withdrawals.

PYUSD’s integration with existing PayPal infrastructure could also open up online gambling to a wider audience already familiar with and comfortable using the platform, leading to increased market growth for online casinos.

PayPal’s recent stablecoin launch is an exciting one for sportsbook and casino operators and should help to drive annual revenues even higher over the next few years.

While mass adoption of cryptocurrencies may still be some years away, its legitimacy will undoubtedly be enhanced if successful industries such as iGaming jump on the bandwagon.